Partners Life Health Insurance Review

Wondering about Partners Life health insurance? Here’s an overview of its Private Medical Cover and other Partners Life policies for Kiwis.

Download our insurance comparison chart

We need a few details before we can send you this content…

* All fields are required

Partners Life knows that sometimes “bad things can happen,” and that the best way to deal with untoward situations is to offer Kiwis protection when they need it most.

From its beginnings in 2011, Partners Life has “focused on building strong and lasting partnerships.” Since then, the company has consistently achieved the Lewers Research five-star approval rating (Lewers Survey) - indication of Partners Life’s total dedication to customer service.

Partners Life private health insurance policies are only available through an approved adviser.

In this Partners Life private health insurance review, we’ll look at plans available through Policywise. You can also download our FREE hospital cover comparison table below to check out other plans, or contact us today for free quotes and personalised recommendations.

Health | Life | Trauma | Total and Permanent Disability | Income Protection

Learn more on different types of insurance from an expert licenced financial adviser and see what's best for your circumstances.

Learn more about different types of insurance from a licenced financial adviser and see what's best for your circumstances.

Health | Life | Trauma | Total and Permanent Disability | Income Protection

Partners Life Medical Insurance - a brief company overview

Partners Life began as a New Zealand start-up company around a decade ago. In that short time, it’s grown to become one of New Zealand’s most trusted health, life, and business insurance providers. Partners Life pays out around 89% of claims each year.

Partners Life received the ANZIIF Life Insurance Company of the Year award for 2022, recognising a strong dedication to clients and an ongoing pursuit of better solutions. Since its inception, the company has also consistently achieved the Lewers Research five-star approval rating (Lewers Survey), indicating Partners Life’s total dedication to customer service.

Partners Life believes that there’s no one-size-fits-all insurance product. The company encourages Kiwis to work with licenced financial advisers who can help them choose and tailor insurance cover to fit their own needs.

Partners Life offers a range of insurance products including:

- Health insurance

- Life insurance

- Disability insurance

- Trauma cover

- Income protection

- Business risk protection

Partners Life believes that there’s no one-size-fits-all insurance product. The company encourages Kiwis to work with licenced financial advisers who can help them choose and tailor insurance cover to fit their own needs.

Key facts about Partners Life |

Founded: 2011 |

| Premium revenue (revenue from policy premiums): $427.9 million (31 March 2022) |

| Accumulated claims paid: $85.5million (1 April 2022 to 31 March 2023 |

| Claims approved: 89% |

| Solvency margin (assets after debts): $98.5 million (31 December 2023) |

| Solvency ratio (cash flow sufficiency): 109% (as of 31 December 2023) |

| Financial strength rating: A (Excellent) A.M. Best |

Partners Life Private Medical Cover

Kiwis who take out Partners Life Private Medical Cover receive faster treatment at private health facilities, without having to worry about the costs. And those costs can be significant. For example, knee or hip replacements: up to $30,000; a spinal fusion: potentially, $80,000 - daunting figures to say the least.

Private medical insurance also offers broader treatment options, such as access to non-Pharmac-funded drugs and unlimited access to specialists for second opinions.

Partners Life Private Medical Cover highlights:

Base Cover |

Limits per policy year |

Hospital surgical benefit |

Up to $600,000 |

Non-surgical benefit

|

Up to $500,000 |

Reconstruction surgery |

Up to $600,000 |

Up to $600,000* |

|

Diagnostics and tests |

Up to $200,000 |

Hospital specialist consultations benefits |

Up to $300,000*** |

Overseas treatment |

Up to $60,000 |

Second opinion benefit |

Unlimited |

Hospital cash benefit |

$300 per night |

* Up to the hospital surgical or medical benefit Limit, whichever applies *** Up to the hospital medical benefit limit

Partners Life Private Medical Cover also provides a range of additional benefits, including:

- Overseas waiting list and medical tourism benefits

- Serious illness dental benefit

- Recovery support for post treatment consultations

- Home nursing care benefit

- Support person transport & accommodation benefits

- Funeral support benefit

- Medical misadventure benefit

OPTIONAL COVER

You can boost your Private Medical Cover with the Specialist and Tests option for consultations and diagnostic procedures not covered in the life assured’s plan. Consultations with obstetricians, registered osteopaths, acupuncturists, chiropractors, homeopaths, naturopaths, and podiatrists are all included if referred by a GP.

Partners Life will also pay for treatment recommended by these specialists, up to $10,000 per policy year.

Partners Life Medical Cover is truly comprehensive, but if you’re still not sure this is the best policy for you, then arrange a chat with a friendly Policywise expert.

More ways to boost your Private Medical Cover

Specific Condition Cover and Hospital Cash Cover are stand-alone plans, but you can also add them to your Partners Life Private Medical Cover for even greater benefits.

Specific Condition Cover

Partners Life pays a lump sum benefit if the life assured suffers a specific illness or injury. Examples of these events include:

- Irreversible heart impairment

- Loss of sight or limb

- Parkinson’s disease or motor neurone disease

- Permanent full or partial disability

- Spine or joint surgery

- Chemotherapy or organ transplant

In addition to the lump sum benefit, Partners Life will also pay you the following:

- Childcare assistance benefit for additional childcare costs incurred as a result of the specific condition the life assured has an approved claim for.

- Return to home benefit: If a member has lived or worked overseas for over three consecutive months and claims against a Specific Condition, Partners Life will cover the transportation expenses for their travel back to New Zealand.

Use Specific Condition Cover to make up for lost income, pay for home modifications, or whatever else is necessary - it’s entirely up to you.

Hospital Cash Cover

Hospital Cash Cover pays a lump sum benefit to help cover the additional expenses - such as loss of income, accommodation and transport costs - that come with significant illness. Cover applies in New Zealand and Australia as well as worldwide (with limitations).

Medical conditions covered by Hospital Cash Cover include:

- Diagnostics such as angiogram, MRI, colonoscopy CT scan

- Prostatectomy

- Fractures

- Angioplasty

- Inpatient surgery

- Mastectomy

- Transplant (liver, kidney, heart, lung, bone marrow)

Hospital Cash Cover will also pay a cash benefit for admission to a private or public hospital or hospice lasting more than three consecutive nights.

As with all insurance plans, the Partners Life policy document specifies terms and conditions not listed here. An approved insurance/financial adviser (such as Policywise) can clarify these.

RECOMMENDED READINGS

Comparing health insurance plans in New Zealand

What’s a health insurance excess and how can it lower your premium?

Long waiting lists in NZ's public health system

Other Partners Life Insurance options

Partners Life offers other types of limited cover that may suit you if you feel you can’t afford a more comprehensive policy. Policywise can talk you through these options, but you may find that good cover is manageable after all.

We’ve summarised some of these slightly more restricted covers below.

- Terminal Illness Cover pays a one-off lump sum if you are diagnosed with a terminal illness.

- Life Cover pays a one-off lump sum amount if you pass away or become terminally ill.

Members and/or their families can use the lump sum benefit to pay debts, mortgages, or funeral expenses. It can also be used to finance your children’s education, build an investment kitty, start a business, or contribute towards an inheritance fund.

- Life Income Cover/Income Cover pays a monthly benefit for a set duration if the life assured dies or is diagnosed with a terminal illness.

- Income and Expenses Cover provides cover for clients if they can’t work due to an accident or illness.

- Mortgage Repayment Cover pays your mortgage even if you need to stop earning while you’re sick or injured.

- Household Expenses Cover helps pay for living expenses if injury or a health condition prevents you from going back to work.

You can even pair these products to ensure that all your monthly financial obligations get paid on time.

You can also take advantage of a range of trauma covers. These insurance products pay you a lump sum if you are diagnosed with or suffer from any of the serious health conditions covered in your policy.

Use the fund to cover medical costs related to your treatment and recovery, such as home modifications to accommodate your condition, equipment like wheelchairs, and other expenses.

Examples of conditions covered include:

- Cancer

- Stroke, heart attack, or open heart surgery

- Alzheimer’s disease and dementia

- Multiple sclerosis

- Diabetes

- Chronic kidney, liver, or lung failure

- Severe inflammatory bowel disease

Total and Permanent Disability Cover

This cover pays a lump sum if you’re permanently unable to work following a severe illness or injury. You can use the Total and Permanent Disability fund to cover your living expenses, debts, medical costs, and other bills.

Partners Life is proud of a few special features

Partners Life is proud of its excellent connection with members. The company strengthens this association by offering benefits that stand out from the crowd, including:

- Cover for non-Pharmac subsidised drugs at no additional cost (Private Medical Cover)

- Payout on a truly impressive 91% of claims

- Guaranteed policy wording for as long as your policy is in place

- Free policy upgrades: if we add/ improve benefits after you sign up, you get them too

Things to note about Partners Life medical insurance policies

- Pre-existing conditions may not be covered, depending on your policy type

- Overseas medical treatments are not covered unless approved and unavailable in NZ

- Some specific cover types do offer worldwide coverage e.g. Life income

- Cover starts immediately although some loyalty covers have a stand down period

The above is just a brief summary. Additional terms and conditions may apply.

You can wade through all the fine print in the Partners Life policy documents, or simply check in with one of the experts at Policywise and we’ll help you choose the right product for your situation.

RECOMMENDED READINGS

Accuro health insurance review

AIA NZ health insurance review

nib NZ health insurance review

Southern Cross health insurance review

How do I file claims?

We highly recommend applying for pre-approval from Partners Life before incurring costs for medical procedures. This confirms that the expense or treatment is covered by your policy. Obtaining pre-approval may not be possible in an emergency, however, you can still file reimbursement claims for costs you’ve already paid for.

Below are the requirements for pre-approvals or claims:

- Completed claim form.

- Original copy of the estimated cost (for pre-approvals).

- Original copies of the medical bills (for reimbursements).

- Full details of the treatment, including reason for treatment, date received, and required medications.

If you signed up with Policywise, we can help you obtain pre-approval and make the whole process easier and less stressful.

Do you need health insurance in New Zealand?

Wait times for essential and elective surgery are increasing each year. These delays can lead to much poorer health outcomes as well as increased stress and frustration. Health insurance can also pay for expensive treatments that are not publicly funded in New Zealand.

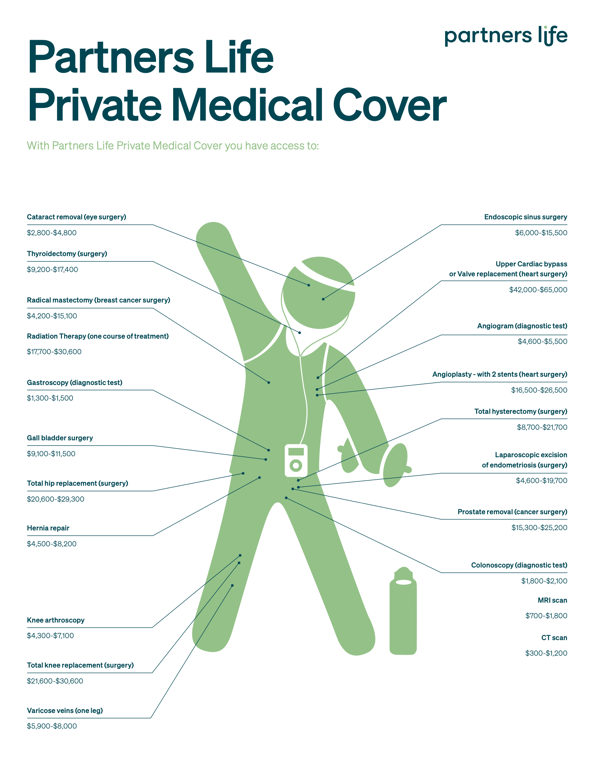

How much can you expect to pay privately for some common treatments in New Zealand?

Good health is priceless. Partners Life Medical Insurance can help you:

- Avoid lengthy wait times for major surgery

- Access expensive, non-Pharmac-funded drugs

- Receive better aftercare support and rehabilitation

- Reduce stress and uncertainty in times of illness

- Get back on your feet faster so you can keep doing the things you love.

Why choose Policywise?

Policywise is a 100% free service which tells you which health, life, and disability insurance provider best fits your needs. We provide quotes and a comprehensive comparison of all leading providers - such as Partners Life - as well as a simple, one-page summary clearly stating how our findings dovetail with your situation.

Not all health insurance policies are the same. Policywise can help you sort out the duds, avoid the lemons, understand the fine print and exclusions, and get the best insurance for you and your family.

We’ll answer all your questions, provide fast, easy-to-understand policy comparisons and quotes, and take care of the sign-up process. We can also take care of lodging any claims on your behalf.

Now is the time to think about investing in private health insurance cover that will give you or someone you love the most outstanding support and treatment possible in the event of illness. How about having a 5-minute phone conversation with us? Together, we can find the ultimate path towards securing your financial and physical health.

Important Disclaimer: The information on this website is general in nature and does not consider your personal situation. It is not intended as a definitive financial guide. Before making any KiwiSaver or insurance decisions, we recommend speaking with a licensed Policywise adviser.

Policywise advisers are licensed by the Financial Markets Authority to give financial advice on KiwiSaver and health, life, and disability insurance. For more, see our Public Disclosure page.

All insurance is subject to insurer approval. Policies may include stand-down periods, exclusions, terms and conditions, and premium loadings not listed here. Optional (add-on) benefits come at an extra cost. Please refer to the relevant policy document for full and current details, as insurers may update these at any time.

Product pages on this site are summaries only. In the case of any difference between website content and the provider’s official policy wording, the provider’s wording will apply.

Quickly find the cover that’s best for you

Policywise tells you which health, life or disability insurance best matches your circumstances, 100% free. Talk to one of our insurance advisers to find out which health or life insurance is best for you.

References

- About: https://www.partnerslife.co.nz/why-partners-life Retrieved 3/09/2022

- Financial strength: https://www.insurancebusinessmag.com/nz/companies/partners-life/215239/ Retrieved 3/09/2022

- https://www.partnerslife.co.nz/solvency-and-financial-strength Retrieved 3/09/2022

- Lewers Survey: https://www.lewers.com.au/ Retrieved 3/09/2022

ON THIS PAGE

Download our insurance comparison chart

We need a few details before we can send you this content…

* All fields are required