nib NZ Health Insurance Review 2026: Individuals & Businesses

nib New Zealand private health insurance offers excellent plans to help Kiwis live happier, healthier lives. Learn more about the benefits of nib NZ here.

Download our insurance comparison chart

We need a few details before we can send you this content…

* All fields are required

nib New Zealand says its mission is to: “Help Kiwis and their families live healthier, happier lives” and help local businesses who want to, “Improve workplace wellbeing with tailored cover that includes hospital and everyday treatment”.

nib delivers these objectives by offering affordable, easy-to-use health insurance cover while also supporting healthier lifestyle choices for its members.

In this nib private health insurance review, we’ll look at plans available through Policywise. You can also download our FREE hospital cover comparison table below to check out other plans, or contact us today for free quotes and personalised recommendations.

Health | Life | Trauma | Total and Permanent Disability | Income Protection

Learn more on different types of insurance from an expert licenced financial adviser and see what's best for your circumstances.

Learn more about different types of insurance from a licenced financial adviser and see what's best for your circumstances.

Health | Life | Trauma | Total and Permanent Disability | Income Protection

nib Group - Who are they?

nib New Zealand is part of nib Group, one of Australasia’s largest and fastest-growing providers of health, travel, and life insurance. Originally established in 1952 as a hospital fund for steelworkers in New South Wales, the company has since expanded significantly, entering the New Zealand market in 2012 through the acquisition of Tower Medical Insurance Limited and then OnePath’s medical portfolio in 2015.

Today, nib supports over 1.6 million residents, students, and workers across Australia and New Zealand with a range of accessible, affordable insurance options. Its New Zealand arm continues to grow, most recently with the acquisition of Kiwi Insurance Limited.

Financially, nib NZ remains strong, with a premium revenue of $218 million for the first half of the 2025 financial year and an A (Strong) financial strength rating from S&P Global Ratings.

Policywise works with the full suite of nib Ultimate insurance products, including medical, trauma, income protection, mortgage protection, and total and permanent disability cover. In this review, we’ll look at their Ultimate Life Insurance plan in detail.

Key facts about nib |

| Founded: 1952 in Australia |

Location: Auckland, New Zealand |

Financial strength rating: A (Strong) S&P Global Ratings Australia Pty Ltd |

| Solvency details (31 March 2025) | ||

| Statutory fund | All of nib NZ Limited | |

| Solvency capital | $38.50m | $679.0m |

| Adjusted prescribed capital requirement | $24.6m | $605.3m |

| Adjusted solvency margin | $13.9m | $74.5m |

| Adjusted solvency ratio | 157% | 112% |

nib NZ Health Insurance Plans

Some of nib’s most comprehensive health covers (such as nib Ultimate Health Max) are only available through a Policywise adviser. These plans offer excellent cover for a substantial number of issues and Ultimate Health Max also offers coverage for many non-Pharmac-funded drugs. Our team can clarify the specific details of these plans and explain how they might work well for you. Here’s a brief description of Ultimate Health Max:

nib Ultimate Health Max

As the name suggests, this plan offers you and your family the ultimate protection, providing insurance for major health costs, including:

- Surgical costs up to $600,000

- Non-surgical treatments up to $300,000

- Oral surgery

- Specialist consults (for second opinions)

- Diagnostic investigations

- Overseas treatment and cover for Australia

- Non-Pharmac-funded drugs.

It also offers a huge range of benefits you might not have thought of:

- Travel and accommodation for treatment

- Funeral support benefit

- Suspension of cover

- ACC top-ups

- Post-hospital home care

- Daily cash benefit while in hospital

- Pre-existing cover for newborns.

nib Ultimate Health Max–extra benefits

Ultimate Health Max’s non-Pharmac cover has higher limits for Medsafe-approved drugs. Without health insurance, these drugs could cost you thousands of dollars - which is why talking to a Policywise adviser is such a wise idea.

You also benefit from:

- Daily cash payout for hospice stays

- Complementary mental health cover for the first year, up to $2,500, for each person covered. Includes registered psychologist and/or psychiatrist consultations with an approved GP referral.

- 25% off the total price of a pair of glasses and lens option, plus a free OCT scan with Specsavers.

- Counselling and support for cancer and cardiac treatment

- Premium waiver up to six months for terminal illness before age 70

- Loyalty benefits - breast reduction and bariatric surgery.

nib is especially proud of a few special features

Guaranteed wording. Ultimate Health Max is one of the few policies on the market today that promises to protect your cover from changes to policy wordings or terms, unless:

- Legal requirements force changes (e.g. taxation)

- The policy owner and/or insured person failed to disclose information

- New benefits or increases for existing benefits are added to the policy.

Optional add ons

nib private health insurance offers optional add-ons that you can include with your Ultimate Health Max cover. Below is just a selection of what’s available.

Specialist option

Covers the cost of specialist consultations for diagnoses and treatments that don’t require hospitalisation - great for obtaining second opinions or general diagnostics.

Serious condition Financial Support

One-off lump sum to help reduce the financial stress resulting from a range of serious conditions. You may use this sum in any way you choose.

Dental & Optical

Covers the cost of visits to dentists and optometrists; also osteopaths, chiropractors, and podiatrists.

Non-PHARMAC Plus

Provides additional cover for Medsafe-approved, non-Pharmac drugs used in an approved New Zealand-based hospital or private medical facility. You can choose additional cover starting from $20,000 up to $300,000.

nib Easy Health

nib’s Easy Health plan provides excellent cover for major procedures and treatments requiring private hospital care. It also pays for many of the associated costs.

Easy Health will cover some pre-existing conditions after three years - a unique advantage - plus you can mix and match different types of cover, insure your children and grandchildren without holding cover of your own, and add extra family members at any time. As for all nib members, you'll also receive 25% off the total price of a pair of glasses and lens option, and a free OCT scan with Specsavers.

Easy Health offers:

- Surgical-related benefits up to $300,000

- Non-surgical-related benefits up to $200,000

- Oral surgery

- Cancer treatments

- Follow-up investigations for cancer

- ACC top-up

- Specialist consultations

- Diagnostic investigations.

Things to note about nib policies

- You have a 14-day free look period; we’ll refund your premiums if you’re not happy.

- Cover begins immediately; there may be a stand-down period for some benefits.

- Many pre-existing conditions are covered but not all.

- You’ll need to complete a pre-sign-up health assessment.

The above is just a brief summary. Additional terms and conditions may apply.

Schedule a 5-minute callback with Policywise to chat in more detail about nib NZ’s full terms and conditions. Our Policywise advisers are qualified professionals who make recommendations based on your needs, budget, and health history.

Does nib offer budget health cover?

Yes, Policywise can organise a nib simplified health cover for you and your loved ones. You can also ramp up your cover with add-ons such as Non-Pharmac Plus, Serious Condition Lump Sum, and Pro-active Health.

Even better, you can lower your premium payments by as much as 60% when you choose to pay a higher health insurance excess. It really is that simple! And our Policywise advisers can organise it all for you - completely free of charge.

RECOMMENDED READINGS

Best health insurance in New Zealand

Accuro - New Zealand’s best little health insurer

AIA NZ health insurance review

Partners Life health insurance review

Southern Cross health insurance

nib Health insurance for businesses: Caring for your employees

Offering your valuable employees a decent health cover plan is a great way to show staff you appreciate them. It’s a given that employee health insurance:

- Encourages motivation and productivity

- Improves the wellbeing of your team

- Means fewer days off for severe illness.

And your employees will be more focused on the job because they’re not worrying about having to wait for medical treatment, taking time off work, or mounting medical bills. Employee health insurance is a great addition to your business toolbox. In fact, Seek calls it the No.1 Perk that will make a job candidate choose you over your competitor.

And that’s why nib also offers Premier Health Business.

nib Premier Health Business

A flexible and highly comprehensive private health insurance policy that you can adapt to your organisation’s needs. Start with the Base Pack. This includes cover for the following:

- Surgical costs of up to $300,000 per person

- Medical costs of up to $200,000 per person

- Cancer treatment

- Major diagnostic tests

- Treatment costs in Australia and NZ (some exclusions)

- Rehabilitation costs - post-treatment nursing and therapy

- All pre-existing conditions (when you cover for 15 or more people).

Then add options such as:

- Specialist consultations even when private treatment is not required

- Serious condition lump sum payout - options: $20,000 or $50,000

- GP option - for GP visits, prescriptions, and minor surgeries. Also pays for gym membership

- Dental and optical

- Hearing and joint/spine health

- Proactive Health - health screening, allergy testing, dietary advice, gym memberships

- Non-Pharmac-funded drugs; members can choose cover from $20,000, $50,000, $100,000, or $200,000.

That’s just a brief summary of benefits; more details are available in nib’s policy documents. Talk to one of our expert Policywise advisers and learn more about how nib Premier Health Business can help your staff thrive at work - every day.

NIB Health Management Programmes

nib NZ wants to partner with you to improve your health and wellbeing. A range of health and wellness management programmes are available for eligible members across all nib hospital policies.

The team at Policywise can update you on nib’s Health Management Programme in more detail when you give us a call. In the meantime, here’s a brief sample of just a few of the plans currently on offer:

- nib Healthier Joints: Weight Management - this programme aims to help prevent or delay a hip/knee replacement due to osteoarthritis or any similar health condition.

- nib Healthier Joints: Pain Management - provides the psychological or physiotherapy support you need when dealing with chronic pain in the shoulders, knees, back or hips.

- nib Healthier Heart - helps you reduce the risk of a heart-related disease through better medication management and lifestyle choices, and supports you in reaching your health goals.

- nib Cancer Care - helps cancer sufferers and their carers access support and guidance during chemotherapy or radiotherapy.

mynib app + nib Insurance: it couldn’t be easier

If you are already a nib NZ private insurance policyholder, you can find information about your health cover, policy documents, acceptance or renewal certificates, and other details through the easy-to-use my nib portal.

It’s simple to download the my nib app for iPhone or Android, or simply register and log in online.

Alternatively, our Policywise advisers can access, translate, and clarify your existing nib health cover for you. We’re here to make things painless (and the service is 100% free).

How to Check Your Policy Coverage

Follow the steps below to find out what you're covered for:

- Sign in through the my nib portal.

- Search for your health insurance plan or the year your coverage began.

- Under your current plan, look for the items that are or aren’t covered.

- Find out who is covered under your current plan by checking your personal documents (Acceptance or Renewal Certificate).

- Look for any specific terms and conditions that may apply to your case.

Remember, some conditions or treatments may require pre-approval. It’s advisable to verify this before choosing a treatment provider.

How to Claim

Making a claim with nib health insurance is simple. If you’ve checked that you’re covered, then simply send the receipt through my nib for everyday medical costs such as visits to a GP.

For diagnostic tests, specialist consults and surgeries, simply send the invoice together with your claim. Be aware that some healthcare providers may require a pre-approval letter from nib before starting any treatment.

You can also claim your nib NZ insurance through Policywise. We’ll verify your claim with the insurer and smooth things over in those very rare instances when an issue with your claim arises. Policywise aims to make health insurance totally stress-free so you can focus on getting back on your feet as quickly as possible.

Do you need health insurance in New Zealand?

Wait times for essential and elective surgery are increasing each year. These delays can lead to much poorer health outcomes as well as increased stress and frustration. Health insurance can also pay for expensive treatments that are not publicly funded in New Zealand, making it a worthwhile investment.

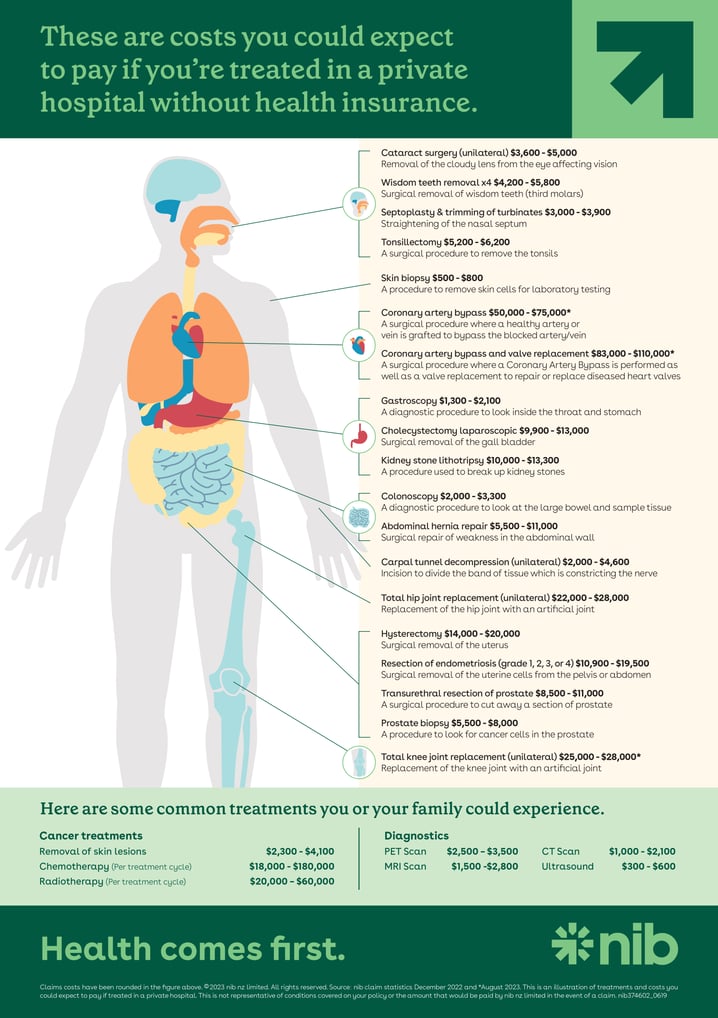

Common private treatment costs in New Zealand:

Good health is priceless. Private health insurance can help you:

- Avoid lengthy wait times for major surgery

- Access expensive non-Pharmac-funded drugs

- Receive better aftercare support and rehabilitation

- Reduce stress and uncertainty in times of illness

- Get back on your feet faster so you can keep doing the things you love.

Why choose Policywise?

Policywise is a 100% free service which tells you which health, life, and disability insurance provider best fits your needs. We provide quotes and a comprehensive comparison of all leading providers - such as nib - as well as a simple, one-page summary clearly stating how our findings dovetail with your situation.

Not all health insurance policies are the same. Policywise can help you sort out the duds, avoid the lemons, understand the fine print and exclusions, and get the best insurance for you and your family.

We’ll answer all your questions, provide fast, easy-to-understand policy comparisons and quotes, and take care of the sign-up process. We can also take care of lodging any claims on your behalf.

Now is the time to think about investing in private health insurance cover that will give you or someone you love the most outstanding support and treatment possible in the event of illness. How about having a 5-minute phone conversation with us? Together, we can find the ultimate path towards securing your financial and physical good health.

Important Disclaimer: The information on this website is general in nature and does not consider your personal situation. It is not intended as a definitive financial guide. Before making any KiwiSaver or insurance decisions, we recommend speaking with a licensed Policywise adviser.

Policywise advisers are licensed by the Financial Markets Authority to give financial advice on KiwiSaver and health, life, and disability insurance. For more, see our Public Disclosure page.

All insurance is subject to insurer approval. Policies may include stand-down periods, exclusions, terms and conditions, and premium loadings not listed here. Optional (add-on) benefits come at an extra cost. Please refer to the relevant policy document for full and current details, as insurers may update these at any time.

Product pages on this site are summaries only. In the case of any difference between website content and the provider’s official policy wording, the provider’s wording will apply.

Quickly find the cover that’s best for you

Policywise tells you which health, life or disability insurance best matches your circumstances, 100% free. Talk to one of our insurance advisers to find out which health or life insurance is best for you.

References

- About nib https://www.nib.co.nz/about-nib/ Retrieved 29/08/2022

- Financial strength https://www.nib.co.nz/about-nib/financial-advice/ Retrieved 29/08/2022

- https://www.nib.com.au/docs/fy2022-full-year-results-asx-announcement

Retrieved 29/08/2022 - https://www.nib.com.au/docs/2022-annual-report Retrieved 29/08/2022

- https://www.spglobal.com/ratings/en/about/intro-to-credit-ratings Retrieved 29/08/2022

- nib policies https://www.nib.co.nz/adviser-plans Retrieved 29/08/2022

- Compare Plans https://www.nib.co.nz/compare-plans Retrieved December 10, 2021

- Health Insurance through an Adviser https://www.nib.co.nz/adviser-plans Retrieved December 10, 2021

- nib Claims https://www.nib.co.nz/claims/ Retrieved 21/08/2022

- What am I Covered For? https://www.nib.co.nz/am-i-covered/ Retrieved December 10, 2021

- Things to know https://www.nib.co.nz/compare-plans#things-to-know Retrieved 20/08/2022

- Premier Health Business https://www.seek.co.nz/employer/market-insights/top-5-work-perks-employees-want Retrieved 21/08/2022

- https://health.nib.co.nz/business Retrieved 21/08/2022

- https://www.nib.com.au/docs/premier-health-business-fact-sheet Retrieved 21/08/2022

- Mynib https://mynib.co.nz/Account?ReturnUrl=%2F#Promoter2 Retrieved 21/08/2022

ON THIS PAGE

Download our insurance comparison chart

We need a few details before we can send you this content…

* All fields are required