Best health insurance in New Zealand (2026): Compare medical plans and quotes

Compare medical covers and quotes from New Zealand's best insurers. Get a FREE comparison of plans from Accuro, AIA, nib, Partners Life, and Southern Cross.

Download our insurance comparison chart

We need a few details before we can send you this content…

* All fields are required

Comparing private health insurance plans? This 2026 guide lists medical insurance plans from New Zealand’s best health insurance providers: Accuro, AIA, nib, Partners Life, and Southern Cross.

Looking for the best hospital cover? Compare plans instantly by downloading our FREE hospital cover comparison table below. If you want to speak to someone directly, book a call with one of our friendly Policywise specialists.

Learn more about different types of insurance from a licenced financial adviser and see what's best for your circumstances.

nib | Accuro | Southern Cross | Partners Life | AIA

Learn more about different types of insurance from a licenced financial adviser and see what's best for your circumstances.

Health | Life | Trauma | Total and Permanent Disability | Income Protection

Best private health insurance providers in NZ (2026)

Health insurance company |

Financial strength rating |

Health insurance plans |

| Accuro (now under UniMed) | UniMed: A (Excellent) A.M. Best |

|

| AIA | AA (Very Strong) Fitch Ratings |

|

| nib | A (Strong) S&P Global Ratings (Australia) Pty Ltd |

|

| Partners Life | A (Excellent) A.M. Best |

|

| Southern Cross | A+ (Strong) S&P Global Ratings (Australia) Pty Ltd |

|

Accuro (now under UniMed)

Accuro is a not-for-profit health insurance cooperative offering health insurance plans for:

- New Zealand citizens and permanent residents

- work visa holders who are staying in New Zealand for less than two years

- babies and kids

- small, medium, and large businesses.

Accuro’s health insurance plans primarily include hospital and surgery cover. Everyday plans, like dental cover and GP consultations, can be purchased as add-ons.

Individual plans

- SmartCare: Covers general and oral surgery, major diagnostic procedures and private hospital admission.

- SmartCare+: In addition to the benefits under SmartCare, this plan also covers non-Pharmac drugs (up to $500,000 per policy year) and has higher cover limits (i.e., up to $500,000 for general surgery, $300,000 for oral surgery, and $300,000 for private hospitalisation and cancer treatment).

Plan for babies and children

- KidSmart’s base plan includes cover for general and oral surgery, major diagnostic procedures, private hospital admission, and non-Pharmac drugs.

Plan for visitors and work visa holders staying for less than two years

- SmartStay includes cover for general and oral surgery, private and public hospital admission, major diagnostic procedures, minor surgery, and reimbursement for overseas treatment.

Business plans

Accuro offers the following:

- StaffCare: A hospital and surgical package with add-ons including specialist and GP cover.

- StaffCare+: StaffCare benefits plus non-Pharmac-funded chemotherapy and higher benefit limits per policy.

AIA

AIA’s individual health insurance products include:

- Private Health: Covers surgery, hospitalisation (up to $500,000 per policy year), cancer treatment (up to $500,000), consultations with specialists and mental health professionals, diagnostic tests, and overseas treatment.

- Cancer Care: Covers the cost of diagnostics, treatment (both Pharmac and non-Pharmac-funded drugs), recovery and overseas treatment.

- Specialist and Testing Support: Provides entry-level cover for specialist consultations (up to $10,000) and diagnostic tests or procedures (up to $100,000) when referred by a medical practitioner.

nib

nib New Zealand is part of nib Group, which specialises in health and medical insurance for Australian and New Zealand residents.

Policywise offers the following nib individual and family plans:

- Easy Health covers surgery, non-surgical/hospital medical benefits, cancer treatment and follow-ups, post-hospital home nursing care, ACC top-up, specialist consultations, diagnostic exams, public hospital cash grant, overseas treatment, non-Pharmac-funded chemotherapy drugs, and more. Optional add-ons include serious condition lump sum and extra non-Pharmac cover.

- Ultimate Health is a more extensive plan than Easy Health and has higher cover limits (up to $600,000 per policy year for surgical benefits and up to $300,000 for non-surgical benefits). Ultimate Health also has more optional add-ons, like GP, dental, and optical cover.

- Ultimate Health Max is nib’s most comprehensive plan. It has the same base benefits and add-ons as Ultimate Health, plus cardiac and cancer counselling, support services, and hospice care. It also offers much higher non-Pharmac drug cover up to $600,000 and an option to increase this amount.

nib also offers health insurance plans for businesses. The comprehensive base plan includes hospital surgical and non-surgical costs, diagnostic tests, and cancer treatment. Employers and employees can opt for add-ons like non-Pharmac cover, serious condition lump sum, and dental and optical cover.

Partners Life .png?width=181&height=40&name=PartnersLife_Wordmark_RGB-2%20(1).png)

Partners Life’s health insurance plans for families and businesses include:

- Private Medical Cover that includes hospital surgical benefits (up to $600,000 per policy year), hospital non-surgical benefits (up to $500,000), cancer care, non-Pharmac drugs, and mental health consultations.

- Specific Condition Cover and Hospital Cash Cover: These plans pay a specific amount when the insured experiences a particular health event or needs treatment.

Southern Cross .png?width=215&height=40&name=logo_southern-cross%20(1).png)

Southern Cross offers health plans for individuals, families, and businesses.

The not-for-profit insurer has a variety of individual plans, such as:

- Wellbeing Starter, which covers cancer care, specialist consultations, diagnostic imaging, surgical treatment, GP visits, and tests and recovery after surgery, chemotherapy or radiotherapy.

- Wellbeing One includes broader benefits than Wellbeing Starter and provides cover for non-Pharmac-funded chemotherapy drugs. Clients can also add cover for optical, dental, and natural care services.

- Wellbeing Two shares similar benefits to Wellbeing One, but offers more comprehensive surgical cover.

- UltraCare is a comprehensive plan that includes Wellbeing Two benefits plus some day-to-day health services, like GP visits and chiropractor consultations.

- UltraCare policyholders who want to expand their dental and optical cover can upgrade to UltraCare400.

- HealthEssentials for day-to-day health cover for GP, dental and optical visits.

- RegularCare and KiwiCare are shared cover plans wherein both the policy owner and Southern Cross shoulder expenses for cancer care, surgery, and many other medical expenses.

Depending on your plan, you may have the option to add Cancer Assist (a one-off payment after a qualifying cancer diagnosis), Critical Illness, and Cancer Cover Plus (for additional chemotherapy for cancer and non-Pharmac-funded chemotherapy drugs).

How much does health insurance cost in New Zealand? 2026 quotes

Several factors can affect the cost of your premiums. These include:

- Age: Premium costs increase as you age

- Gender: For example, in early adulthood, women who share the same age and health status as men pay higher premiums

- Smoking status (cigarette smoking and vaping)

- Body mass index (BMI): A high BMI may indicate greater health risks, thereby increasing your premium

- Certain pre-existing conditions

- Level of cover

- Paying an excess: Your health insurance excess is the amount you pay when making a claim. For example, if you choose an excess of $500 and make a claim for a surgery costing $5,000, you will pay $500 and your insurer will pay $4,500. With some plans or insurers, you only have to pay an excess once or twice per year

- Number of dependants included in your policy

- Increasing cost of claims due to medical advancements and inflation

- Frequency of payment: Annual premiums cost less than fortnightly or monthly premiums.

Below are sample quotes for comprehensive hospital plans of Accuro, AIA, nib, Partners Life, and Southern Cross with a $500 excess.

Contact us today to get your FREE, no-obligation health insurance quote

How to get lower health insurance premiums

Below are some excellent ways to lower your premiums or get a deduction:

- Increase your excess

Opting for a plan with a higher excess can lower your premium costs - Get the right add-ons to fit your personal situation

This helps you avoid paying for extra cover that you don’t really need - Maintain a healthy lifestyle

In general, smokers and vapers have higher premiums than non-smokers - Consider your payment method

Some insurers offer price reductions to clients who make direct debit payments or annual premium payments.

Experienced Policywise advisers can help you get the most appropriate, cost-effective health plan for your needs. Contact us to get a quote.

Do you really need private health insurance in New Zealand?

New Zealand has a comprehensive public healthcare system, which generally covers acute conditions and injuries from accidents, subsidised general practitioner (GP) visits and prescriptions, and, for children under 14 years old, free GP consultations.

However, many New Zealanders still face healthcare challenges, especially in getting fast medical attention for chronic conditions. Due to increasing demand, many Kiwis have to wait several months to a few years for elective surgeries in public hospitals.

These long waiting times can have negative consequences on patients’ health and quality of life before and after their treatment. As a result, many Kiwi patients choose to pay for private medical care so they can have their procedures done sooner, especially if their condition is causing them debilitating pain.

New Zealand also lags behind in terms of public funding for modern medicines. According to the International Comparison of Modern Medicines (ICoMM 2) report, public funding was available for only 24 of the 403 modern medicines introduced in the Organisation for Economic Co-operation and Development (OECD) between 2011 and 2018.

Because of this, some Kiwi patients take out loans or mortgages, rely on fundraisers, deplete their emergency savings and retirement funds, or find other ways to be able to afford non-Pharmac-funded drugs.

Benefits of private health insurance

- Shorter wait times. Having health insurance gives you the fast option to go to private hospitals for tests, consultations, and treatments without worrying about the costs. Skipping long waiting times also means you can quickly be free from the pain or discomfort caused by your health condition.

- You no longer have to put your life on hold. You can recover and go back to work or resume your hobbies sooner.

- Cover for non-Pharmac-funded drugs. Depending on your cover and health condition, your insurer may shoulder the cost of non-Pharmac-funded drugs for treating cancer and other diseases.

- Access to better treatment options and facilities. Having health insurance gives you access to high-quality facilities at private hospitals, from the latest technology and equipment to better rooms and beds for patients.

- Peace of mind. Having health insurance gives you greater assurance that you have the resources to afford life-saving or life-extending treatment if you or your loved one needs it.

- More control. Private health insurance gives patients more control over their treatment and more options in terms of which physicians to see, where to get surgery, and how to access Medsafe-approved drugs that aren’t funded by Pharmac.

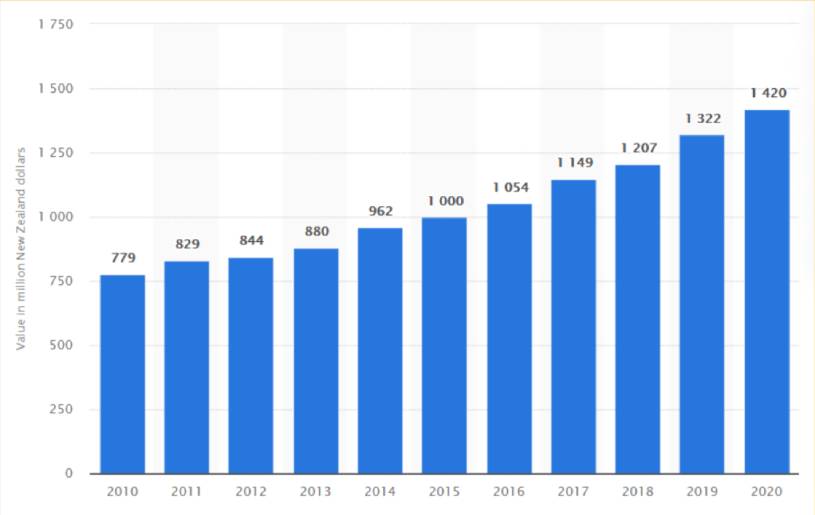

Value of Claims Paid by Health Insurers in New Zealand for Financial Years 2010-2020 (in million NZD)

Source: Thomas Hinton (March 25, 2021). Retrieved April 2, 2022, from https://www.statista.com/statistics/1051074/new-zealand-health-insurance-claims-paid.

What does private health insurance cover?

Private health insurance plans vary greatly in their policy benefits. Plans may cover just day-to-day health costs, or more major expenses, such as hospitalisation and surgery. Other policies offer comprehensive insurance, combining the benefits of everyday plans and hospital cover.

Below are some of the healthcare costs covered by medical insurance. This is not an exhaustive list, and cover will depend on your plan. Some insurers may include these benefits in their base plans, while others offer them as add-ons.

Major policies/hospital cover for major healthcare costs such as:

- Cancer diagnosis, treatment, follow-up consultations, travel and accommodation

- Non-Pharmac-funded Medsafe medications

- Specialist consultations

- Diagnostics, like x-rays, MRI exams, PET scans, and CT angiograms

- In-hospital medical treatment costs

- Hospital surgeries

- Overseas treatment, if needed.

Minor medical expenses/day-to-day treatments including:

- GP consultations

- Dental check-ups and treatments, like cleaning, fillings, extractions, root canal therapy, crowns, dentures, and endodontic and orthodontic treatments

- Pharmaceutical prescriptions

- Mental health services (psychologist or psychiatrist consultations)

- Allied and therapeutic care, such as physiotherapy, chiropractic, acupuncture and traditional Chinese medicine

- Vaccinations.

Comprehensive plans:

- Combine the benefits of minor and major health insurance plans.

How to choose the right health insurance plan

The type of cover appropriate for you and your loved ones will depend on your circumstances and financial situation. But here are a few plans to consider.

Cancer cover

Cancer rates continue to rise in New Zealand, remaining a leading cause of death with over 28,000 new cases and 10,500 deaths in 2022. Private treatment is costly - chemotherapy can range from $15,000 to $170,000 and radiotherapy from $20,000 to $55,000 based on nib’s claims statistics.

Non-Pharmac cover

New Medsafe-approved treatments are available for a number of diseases, but many of these are not yet publicly funded. Health insurance plans with non-Pharmac cover can help patients pay for these treatments.

Hospital surgical cover

This benefit covers in-hospital surgery-related services, such as hospital accommodation and other fees, surgeon and anaesthetist fees, prescriptions, diagnostic exams, and post-treatment care. Hospital surgical cover becomes crucial when patients need elective surgery and want to avoid long wait times at public health facilities.

Non-surgical treatment

Non-surgical benefits cover hospital treatment that doesn’t involve surgery, including accommodation, specialist fees, diagnostic tests, medications, and therapies received during your hospital stay.

Diagnostic procedures

Check the types of tests and amounts your preferred plan will cover for diagnostic procedures, such as colonoscopies, angiograms, and MRI, CT, and PET scans.

Pre-existing conditions

Pre-existing conditions refer to health conditions, symptoms, and injuries you already have when you buy your health insurance plan.

Some health insurers will cover pre-existing conditions after a waiting period or charge higher premiums to have these issues covered. But many of them will not cover the following:

- Cancer (although some may still cover for pre-malignant, pre-existing cancers if the patient has been treated by a registered specialist)

- Cardiovascular conditions

- Hip or knee conditions

- Transplant surgery.

TIP: Taking out health insurance while you’re young ensures easier and broader cover, as you’re less likely to have pre-existing conditions that could limit your benefits later on.

Contact Policywise if you need help understanding health insurance exclusions and pre-existing conditions. Our advisers can negotiate with providers for the lowest number of exclusions and find the best health insurance plan for your medical circumstances.

Exclusions

Below are some procedures and conditions that are often excluded in health insurance policies:

- Organ transplants

- HIV/AIDS

- Dementia

- Cosmetic treatment

- Self-inflicted injuries

- Assisted reproduction

- Health conditions brought about by substance abuse

- Chronic conditions, like asthma and arthritis, and other pre-existing conditions.

Be sure to ask your Policywise adviser about these exclusions and read your insurance plan’s fine print.

How much health insurance do you need?

Insurance plans have differing maximum claim amounts per policy year. Higher limits may be beneficial for conditions like cancer, but are not as necessary for other health issues and procedures.

To give you an idea of how much health insurance you actually need, check out the data below on private healthcare costs with no insurance cover.

Cancer Treatments & Non-PHARMAC Funded Drugs |

Cost (NZD) |

Chemotherapy

|

Over $1 million/year |

Immunotherapy

|

$150,000 for four doses Around $8,000/dose, taken every three weeks; capped at $60,000 under the manufacturer’s cost-share program |

Onasemnogene abeparvovec (Zolgensma; for spinal muscular atrophy) |

$3.1 million/dose |

Nusinersen (Spinraza; for spinal muscular atrophy) |

$1.16 million/year plus one injection every four months (about $125,000 per injection) |

Elexacaftor/tezacaftor/ivacaftor (Trikafta; for cystic fibrosis) |

Close to $500,000/year |

Up to $200,000 |

|

Metastatic melanoma treatment |

Up to $200,000 |

Targeted therapy

|

$132,000/year |

Radiotherapy |

Up to $60,000 |

Hospital Treatments |

Cost (NZD) |

Radical neck dissection |

Up to $170,000 |

Spinal surgery |

Up to $250,000 |

Mastectomy with breast reconstruction |

Up to $100,000 |

Coronary artery bypass and valve replacement |

Up to $110,000 |

Bowel resection |

Up to $60,000 |

Hip replacement |

Up to $40,000 |

Robotic prostatectomy |

Up to $35,000 |

Sinus surgery |

Up to $33,500 |

Total knee joint replacement |

Up to $33,300 |

Up to $25,000 |

|

Varicose veins treatment |

Up to $9,100 |

Wisdom teeth extraction |

Up to $5,800 |

Cataract surgery |

Up to $5,000 |

Grommet insertion |

Up to $7,000 |

Diagnostic Tests & Outpatient Treatments |

Cost (NZD) |

Up to $3,800 |

|

PET scan |

Up to $3,500 |

MRI scan |

Up to $3,000 |

CT scan |

Up to $2,100 |

Ultrasound |

Up to $1,500 |

GP minor surgery |

Up to $400 |

Specialist consultation |

Up to $280 |

Everyday Treatment |

Cost (NZD) |

Dental |

Up to $400 |

Optical |

Up to $400 |

Mental health consultations |

Up to $255 |

Acupuncture |

Up to $80 |

Physiotherapy |

Up to $70 |

GP consultations |

Up to $60 |

Easiest way to compare health insurance online

Comparing health insurance plans and understanding the terms, benefits, inclusions, and exclusions on your own may be overwhelming.

A Policywise adviser can simplify the comparisons for you.

- We help you identify what benefits match your circumstances and the cover you are more likely to need. If you have specific health concerns, health insurance advisers can help you identify which plans and insurers can provide the best cover.

- We give you quotes on plans from multiple health insurers, focusing on the plans most relevant to your needs. You can easily see differences in benefits and prices, and choose the plan that gives you the most appropriate cover for the best value.

- We can negotiate exclusions and loading on your behalf. Premium loading refers to the extra amount some insurers charge applicants that are considered higher risk.

- We can help you understand the details of your plan, including:

- excluded medical conditions and procedures

- insurers’ policies on pre-existing conditions

- yearly limits on hospitalisation, diagnostic procedures, surgeries, cancer care and other benefits

- cover for Pharmac and non-Pharmac-funded drugs

- cover for post-operative treatments and care

- cover for dependants, including children

- cover for procedures that do not require hospitalisation

- ways to get lower premiums.

Policywise advisers provide ongoing support and can help you process and negotiate your claims. Advisers will also coordinate with insurers about changes that affect your policy, such as removing exclusions or adding your new baby to your plan, and can negotiate lower premiums if you quit smoking.

Can I change health insurance companies and plans?

Be sure to consider the implications before switching to a different insurer or plan. For example, if you have pre-existing conditions, these may not be covered (or could have limitations) in your new plan. It’s important to clarify these exclusions with your insurer or health insurance adviser.

Contact Policywise if you need more information and guidance on changing insurers or plans. They can help you weigh the benefits and trade-offs of cancelling your current policy and taking out a new one.

How to make a claim

Do you want an easy, effortless way to make a claim? Let Policywise’s insurance experts do the heavy lifting and file and negotiate claims on your behalf.

If you prefer to file claims on your own, we’ve outlined the general steps below. Be sure to check these with your insurer, in case they have other requirements for making claims. Some insurers may also advise you to download their app to submit your claim online.

1. Go to your GP

Visit a general practitioner who is registered with the Medical Council of New Zealand. If they advise you to see a specialist, ask if they have a recommended clinic or specialist. You can also ask for an open referral, so your health insurer can select a specialist or private hospital for you.

2. Check which providers your health insurer offers full cover for

Some insurers offer full cover only if you go to their affiliated health providers. Be sure to check with your insurer if this is one of their requirements for making a claim.

3. Apply for pre-approval

Once you know what consultations, tests, and procedures you’ll need, ask your insurer about the benefit limits for each and apply for pre-approval.

Securing pre-approval can help you better plan and prepare for your treatment. It gives you the assurance that your claims will be processed and/or you will be reimbursed for healthcare costs. It also allows you to prepare financially in case part of the costs are not covered by your insurance plan.

4.Confirm how your insurer will cover your medical expenses (within benefit limits)

Your health insurer covers the medical cost. Depending on the health insurance plan you have, this may include consultations, procedures, medications, and post-recovery expenses. Your insurer will either pay the healthcare provider directly or reimburse your medical expenses.

If you opted for an excess or a cost-sharing plan, you will be paying for part of the medical bill.

Is private health insurance in NZ worth it?

Private health insurance is a smart and worthwhile investment to protect you and your loved ones’ health and finances in the event of illness requiring costly treatment. Health insurance gives you the assurance that long waiting times will not prevent you or your loved ones from getting life-saving or life-extending treatment, and the premiums you pay entitle you to benefits that could otherwise cost hundreds of thousands of dollars each year.

Important Disclaimer: The information on this website is general in nature and does not consider your personal situation. It is not intended as a definitive financial guide. Before making any KiwiSaver or insurance decisions, we recommend speaking with a licensed Policywise adviser.

Policywise advisers are licensed by the Financial Markets Authority to give financial advice on KiwiSaver and health, life, and disability insurance. For more, see our Public Disclosure page.

All insurance is subject to insurer approval. Policies may include stand-down periods, exclusions, terms and conditions, and premium loadings not listed here. Optional (add-on) benefits come at an extra cost. Please refer to the relevant policy document for full and current details, as insurers may update these at any time.

Product pages on this site are summaries only. In the case of any difference between website content and the provider’s official policy wording, the provider’s wording will apply.

Quickly find the cover that’s best for you

Policywise tells you which health, life or disability insurance best matches your circumstances, 100% free. Talk to one of our insurance advisers to find out which health or life insurance is best for you.

References

-

“AIA Health: Health Insurance.” 2020. AIA. https://www.aia.co.nz/content/dam/nz/en/docs/our-products/brochures/aia-health-insurance.pdf

-

Akoorie, N. “Pharmac Won't Fund Spinal Muscular Atrophy Spinraza.” The New Zealand Herald, April 24, 2020. https://www.nzherald.co.nz/nz/pharmac-wont-fund-drug-spinraza-to-help-children-with-spinal-muscular-atrophy/T4XLXGYTSFR2SQLYGT4M2TTHCI/

-

“Bad Backs Top List of Most Expensive Health Insurance Claims.” Radio New Zealand, October 3, 2021. https://www.rnz.co.nz/news/national/452807/bad-backs-top-list-of-most-expensive-health-insurance-claims.

-

Blommerde, C. “Family's $50,000 Cost for Dad's Life-Extending Bowel Cancer Medicine.” Stuff, September 17, 2020. https://www.stuff.co.nz/national/health/122796033/familys-50000-cost-for-dads-lifeextending-bowel-cancer-medicine

-

“Cancer data web tool.” Health New Zealand Te Whatu Ora, December 12, 2024. https://tewhatuora.shinyapps.io/cancer-web-tool/

-

“Dire Findings – NZ Continues to Rank Last for Modern Medicines Access.” Medicines New Zealand, June 15, 2020. https://www.medicinesnz.co.nz/resources/media-releases/media-releases-single/dire-findings-nz-continues-to-rank-last-for-modern-medicines-access

-

Goodwin, E. “Melanoma Drugs Come at a Cost.” Otago Daily Times, April 30, 2015. https://www.odt.co.nz/news/dunedin/melanoma-drugs-come-cost

-

“Health Insurance.” 2021. nib. https://www.nib.co.nz/health-insurance

-

Hinton, T. “Value of Claims Paid by Health Insurers in New Zealand from Financial Year 2010 to 2020.” Statista, March 25, 2021. https://www.statista.com/statistics/1051074/new-zealand-health-insurance-claims-paid/

-

Lewis, O. “$22k Surgery, or Months of Pain: Public Surgery Wait Times Prompt Patients in Agony to Go Private.” Stuff, October 22, 2019. https://www.stuff.co.nz/national/health/116738965/public-surgery-wait-times-prompt-patients-in-agony-to-go-private

-

McQueen, H. “The 10 Most Expensive Drugs in the US, Period.” GoodRx, September 7, 2021. https://www.goodrx.com/healthcare-access/drug-cost-and-savings/most-expensive-drugs-period

-

Munro, B. “Bruce Munro: Disgraceful Waiting List for Elective Surgeries at Public Hospitals.” The New Zealand Herald, January 18, 2021. https://www.nzherald.co.nz/nz/bruce-munro-disgraceful-waiting-list-for-elective-surgeries-at-public-hospitals/GOGLWKMT4EBFTY7PCBYDZ3P4TY/

-

Mussen, D, and Thomas, R. “Desperate Melanoma Patients Forced to Fundraise for Life-Extending Treatment.” Stuff, February 16, 2016. https://www.stuff.co.nz/national/health/76886372/desperate-melanoma-patients-forced-to-fundraise-for-life-extending-treatment

-

“New Zealand Health System.” New Zealand Ministry of Health. https://www.health.govt.nz/new-zealand-health-system

-

“The True Costs of Surgery.” 2019. HealthCarePlus. https://blog.healthcareplus.org.nz/hcp/the-true-costs-of-surgery

-

“Unfunded Drugs and Clinical Trials.” Bowel Cancer New Zealand. https://bowelcancernz.org.nz/about-bowel-cancer/treatment-options/unfunded-drugs-and-clinical-trials/

-

Witton, B. “The Price of a Life: Stark Choice Facing Kiwis Needing Unfunded Medicines.” Stuff, February 16, 2021. https://www.stuff.co.nz/national/health/124171319/the-price-of-a-life-stark-choice-facing-kiwis-needing-unfunded-medicines

ON THIS PAGE

Download our insurance comparison chart

We need a few details before we can send you this content…

* All fields are required