How to plan, save, and secure your retirement future in NZ

Secure your retirement in NZ with smart planning and saving. Explore how insurance protects your savings, and compare the best options with Policywise.

For many of us, NZ Super alone isn’t enough to live comfortably in retirement. It’s a solid foundation, but you’ll likely need to build on it to cover travel, hobbies, health costs, or even everyday expenses.

The good news is you have options. For more choices and better security, you can grow your retirement nest egg through:

- KiwiSaver

- iwi-based schemes

- working after 65

- freeing up money from your home, or

- creating personal savings and investments outside KiwiSaver.

And don’t forget about insurance. It protects your savings so you won’t have to raid KiwiSaver early when life throws challenges your way, keeping your retirement funds safe for when you need them later in life.

Policywise can compare policies across providers, find cover that suits your lifestyle and budget, and offer support, all at no cost to you.

Health | Life | Trauma | Total and Permanent Disability | Income Protection

Learn more on different types of insurance from an expert licenced financial adviser and see what's best for your circumstances.

Learn more about different types of insurance from a licenced financial adviser and see what's best for your circumstances.

Health | Life | Trauma | Total and Permanent Disability | Income Protection

Retirement planning in New Zealand

What is retirement planning?

Retirement planning is about organising your finances and putting steps in place (like saving, investing, and protecting your assets) so you can live comfortably, with more choice and freedom in your later years.

In New Zealand, there’s no official retirement age. Many people choose to stop working around 65, as this is when New Zealand Superannuation (NZ Super) becomes available. But you don’t have to retire at 65, and unless an exemption to the retirement age rule applies, your employer cannot make you retire because of your age.

Why start saving early?

The earlier you start saving, the more time your money has to grow through the power of regular deposits and compounding interest. Even small contributions can make a big difference over decades.

But don’t worry if you haven’t started saving early. You still have options to boost your retirement savings and find ways to increase and protect your assets.

The key is to start now, wherever you are in your retirement planning journey.

Why NZ Super may not be enough

NZ Super is a pension paid by the government to New Zealanders aged 65 or over, and who:

- are a New Zealand citizen, permanent resident, or hold an NZ residence class visa

- are ordinarily resident in New Zealand, the Cook Islands, Niue or Tokelau at the time of applying

- have lived in New Zealand for at least the required number of years since age 20, including 5 years from age 50. The required number of years ranges from 10 to 20 and is determined by your date of birth. You can also use the time you’ve lived in an NZ realm country (the Cook Islands, Niue, or Tokelau) or one of the countries with a Social Security Agreement (SSA) with New Zealand to meet the residence criteria. SSA countries include Australia, Canada, Denmark, Greece, Ireland, Jersey, Guernsey, Malta, the Netherlands, South Korea and the United Kingdom.

While NZ Super is generous by international standards, it may not be enough to cover all of retirees' expenditures.

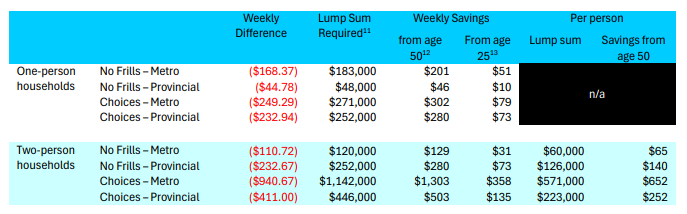

The NZ Retirement Expenditure Guidelines (2024) published by Massey University showed that both single and two-person households typically spent more than the NZ Super rates, even when maintaining a no-frills standard of living. Weekly deficits ranged from $44.78-$249.29 for one-person households and $110.72-$940.67 for two-person households, suggesting that they likely have other income sources on top of NZ Super.

|

Household Type |

Category |

Total Weekly Expenditure ($) |

NZ Super 2024 ($) |

Difference in 2024 ($) |

|

One-person households |

No Frills – Metro |

687.84 |

519.47 |

-168.37 |

|

No Frills – Provincial |

564.25 |

-44.78 |

||

|

Choices – Metro |

768.76 |

-249.29 |

||

|

Choices – Provincial |

752.41 |

-232.94 |

||

|

Two-person households |

No Frills – Metro |

909.90 |

799.18 |

-110.72 |

|

No Frills – Provincial |

1031.85 |

-232.67 |

||

|

Choices – Metro |

1739.85 |

-940.67 |

||

|

Choices – Provincial |

1210.18 |

-411.00 |

Source: Massey University

Even with yearly adjustments for inflation and other factors, NZ Super may not fully meet your financial needs, particularly if you experience large unforeseen costs or wish to maintain a more comfortable retirement.

How much do I need to save for retirement in NZ?

Preparing for a longer retirement

Kiwis today are living longer than ever before. That means you’ll probably need to fund more years of retirement than previous generations. If you retire at 65, you may live another 15-20 years or more.

Here’s a snapshot of how life expectancy in New Zealand has changed over time:

|

Category |

Male |

Female |

|

1970-1972 |

68.5 |

74.6 |

|

1975-1977 |

69 |

75.5 |

|

1980-1982 |

70.4 |

76.4 |

|

1985-1987 |

71.1 |

77.1 |

|

1990-1992 |

72.9 |

78.7 |

|

1995-1997 |

74.4 |

79.7 |

|

2000-2002 |

76.3 |

81.1 |

|

2005-2007 |

78 |

82.2 |

|

2012-2014 |

79.5 |

83.2 |

|

2017-2019 |

80 |

83.5 |

Source: Stats NZ

What affects how much you’ll need to save for retirement

The amount you need to retire in the style you’d like is determined by:

- Your goals and desired lifestyle: Do you picture “no frills” living, or enjoying travel, dinners out, and hobbies? You may need to save more if you want to spend your golden years conquering your bucket list or having a more comfortable lifestyle

- Where you retire: The cost of living in larger cities is typically higher than in regional areas

- Your housing situation: Renting or paying off a mortgage in retirement means you’ll need more savings compared to owning your home outright

- The status of your relationship: Couples usually need more money overall, but also share costs and get more from NZ Super than single retirees

- Your healthcare costs: Medical issues and chronic conditions increase with age, and retirees may find a significant portion of their savings and pension goes to health expenses, home care, or other types of assistance.

How to estimate your needs

You don’t have to guess the numbers. Research tools are available to help you estimate your retirement savings target. You can use the table below from Massey University’s 2024 report to give you an indication.

Estimated savings requirement to fund the differences between expenditure and NZ Super (2024)

Source: Massey University

The table shows your required weekly savings to achieve a corresponding lump sum upon retiring at age 65, with savings starting at either 25 or 50 years of age. This data assumes a life expectancy of 90 and investment in a balanced fund.

For example, if you start saving at 25 years old and aim for a “no frills” retirement in the metro, you need to save $51 per week to achieve the lump sum of $183,000. If you start saving at 50 years old, your required weekly savings would be $201.

Meanwhile, for two-person households aiming at a no-frills retirement in the metro, each partner needs to save $65 per week starting age 50 to accumulate the required savings of $120,000.

For a more personalised estimate, you can use Sorted's retirement calculator. Once you have an idea how much you need, the next step is exploring the best ways to save, invest, and fund your retirement.

Saving and investing for retirement

NZ Super is a great baseline, but for many Kiwis it won’t be enough to cover all living costs in retirement. However, you can top it up. Some options can wait until your later years, while other strategies work best if you start planning well before you retire.

KiwiSaver

KiwiSaver is a voluntary savings scheme designed to help you grow a nest egg for your retirement. If you’re employed, contributions come straight out of your pay. You can boost your retirement savings by increasing your contribution rate from the default 3% to 4%, 6%, 8%, or 10% or make direct payments to your KiwiSaver provider if you want to contribute above the maximum.

If you’re self-employed or not working, you can still make regular or one-off payments directly to your provider or through Inland Revenue.

You can access your KiwiSaver from age 65, but there’s no need to withdraw everything at once. Think about:

- keeping your entire KiwiSaver fund invested so it continues to earn

- making only regular or partial withdrawals, leaving the rest of your funds invested

- continuing your KiwiSaver contributions.

It’s possible to withdraw your KiwiSaver early in cases of significant financial hardship or serious health issues (unless you have insurance to cover these), or if you’re buying your first home. However, doing so will reduce what you have available later on for retirement.

The real power of KiwiSaver comes from the extras:

- Employer contributions of at least 3%

- Government contributions of up to $260 each year if you qualify

- The benefit of compounding returns over time.

Choosing the right KiwiSaver fund and provider will maximise your returns and protect your savings. Speak with Policywise for expert KiwiSaver advice to help you compare which funds best suit your financial goals and risk tolerance.

Iwi-based savings schemes

Some iwi offer their own savings schemes to help whānau build wealth and security. These schemes may provide matched contributions, distributions, or financial education to support intergenerational wealth. Funds may be used for education, buying a first home, or retirement. If you’re eligible, it’s worth checking whether your iwi provides such opportunities.

Keep working after 65

There’s no compulsory retirement age in New Zealand, and many Kiwis keep working past 65. You might prefer full-time, part-time, casual, or consultancy work, or run your own business.

You can still receive NZ Super while you’re working. This extra income can give you financial flexibility, reduce the need to dip into your retirement savings, and let you save a little more before fully retiring.

Generating or freeing up funds from your home

For many Kiwis, the family home is their biggest asset. In retirement, you could use it to unlock extra funds. Options include:

- Downsizing – selling and buying a smaller or cheaper home

- Reverse mortgages – borrowing against your home, with repayment when it’s sold or after you pass away

- Equity release – selling part of your home in exchange for regular income

- Renting out part of your home or taking in a boarder

- Subdividing your property or selling to family while retaining the right to live there.

These ideas can be useful, but they come with trade-offs. It’s best to weigh up the pros and cons, talk with whānau, and seek legal or financial advice.

Personal savings and other investments

You don’t have to rely only on KiwiSaver. You can also save and invest outside of it. That might mean building up a savings account, using term deposits, or exploring other types of investments.

The advantage is flexibility. You’re not locked in until 65, so you can access funds earlier if you need them. The key is to diversify, think about your goals, and choose the options that align with your risk comfort level.

Retirement saving tips for different ages

The tips below are general recommendations to help you focus on what may matter most at each stage of life. However, what applies to one doesn’t apply to everyone. Your circumstances, goals, and resources are unique. If you want a plan that truly fits you, it’s always best to speak with a qualified KiwiSaver adviser for personalised recommendations.

Your 20s: Start strong

- Join KiwiSaver early to maximise compounding growth and increase your contributions, and make voluntary top-ups when you can

- Invest in a growth fund if you have a long investment horizon and can handle short-term market ups and downs. Growth funds typically offer higher long-term returns

- Build an emergency fund that covers at least three to six months of living expenses, so you don’t have to dip into your KiwiSaver and other investments for unexpected costs

- Avoid lifestyle inflation and high-interest debts

- Think about buying a home early. Owning a home can make retirement more affordable and free up more of your funds later

- Review your protection needs. Your health and income are your biggest assets in your 20s. Talk to a Policywise adviser to understand what risks you need to insure against, such as illness, injury, or loss of income

- Get professional guidance. A Policywise adviser can help you compare KiwiSaver funds and providers, assess your risk tolerance, and design a strategy that suits your goals for retirement and financial security.

Your 30s: Build momentum and protect your wealth

- Keep contributing to KiwiSaver and rebuild your balance if you’ve used it for a first home

- Review your KiwiSaver fund to ensure it’s performing well and still aligns with your goals; switch if needed

- Try to get on the property ladder (if you haven’t already) to ease future costs

- Pay off high-interest debt and start investing outside KiwiSaver

- Reassess your health, life, and income protection needs, especially if you have a mortgage or kids. A Policywise adviser can help review your KiwiSaver strategy and insurance needs.

Your 40s: Supercharge your retirement plan

- Check your savings progress against age-based targets and your retirement goals

- Review your KiwiSaver fund and provider to ensure strong performance, the right investment mix, and risk level

- Your 40s are often your peak earning years, giving you a chance to increase contributions, reduce high-interest debt, and diversify your investments beyond KiwiSaver

- Plan your retirement in detail, such as your target spending and income sources

- If you’re behind, step up contributions and invest smarter to get back on track

- Consult a Policywise adviser to check that your KiwiSaver and insurance cover align with your current needs, goals, and stage of life.

Your 50s: Protect and fine-tune your plan

- Take stock of your KiwiSaver balance and projected retirement income. Boost your contributions and take advantage of employer and government contributions

- Gradually shift to more balanced or conservative investments to protect what you’ve built

- Model different retirement ages and part-time work options

- Map out a retirement income and expenses plan. Explore how retiring earlier, later, or working part-time could affect your retirement income

- Review estate documents (will and Enduring Power of Attorney).

Your 60s: Transitioning into retirement with confidence

- Review your KiwiSaver fund to ensure it’s suited to your withdrawal plans and risk tolerance

- Plan how and when to access KiwiSaver, whether as a lump sum, partial withdrawals, or regular payouts

- Create a retirement income plan that combines KiwiSaver, NZ Super, and other savings or investments for steady cash flow

- Consider semi-retirement to keep income flowing

- Confirm your budget matches your lifestyle goals and adjust as needed.

Other strategies to protect your retirement plan

Even if you are saving well, there are a few extra steps you can take to protect your retirement fund and avoid unnecessary stress.

Pay off debt before retirement

Focus on clearing debts and your mortgage before retiring. When the mortgage is gone, you’ll continue to manage insurance, maintenance, and utilities, but won’t need to worry about repayments if illness or job loss occurs.

Keep an emergency fund

Having an emergency fund means you might not need to withdraw from your KiwiSaver or sell investments too soon. Aim to save several months' worth of living expenses in a high-interest savings account or term deposit. During your retirement, increase your emergency savings, as medical expenses may arise more often.

While an emergency fund can help, some health expenses and their financial consequences (such as long-term work absences or a permanent disability) may be too large to cover on your own. That’s why insurance is important, giving you peace of mind that you won’t need to deplete your retirement savings and assets if you or your loved one suffers a serious illness or needs long-term care.

Leverage insurance to protect your retirement savings

Building up retirement savings is one side of the equation. Protecting those savings is just as valuable. Below are some ways different insurance products can help:

How it prevents early KiwiSaver withdrawals |

How it helps increase retirement savings |

|

Provides a lump sum if you’re diagnosed with a terminal illness or pass away, so your family don’t need to dip into their KiwiSaver for living costs or your medical and funeral expenses |

Ensures your loved ones’ financial security, leaving their KiwiSaver intact to grow | |

|

|

Covers private medical treatment costs, reducing the need to withdraw KiwiSaver for surgeries, cancer treatment, and non-Pharmac-funded drugs | Protects your savings from being eroded by health expenses, allowing investments to compound |

| Trauma / critical illness insurance | Pays a lump sum if you’re diagnosed with a covered critical illness or injury, preventing illness and hardship-related withdrawals | Provides financial support for medical and living costs while you recover, leaving your KiwiSaver untouched |

| Provides a lump sum if you’re permanently disabled, reducing the need to access KiwiSaver early | Preserves your retirement fund amidst long-term health challenges, potential job loss, and career changes | |

| Income protection insurance | Provides monthly benefits if you’re unable to work due to illness or injury. Some plans include a retirement protection benefit where the insurer continues KiwiSaver contributions on your behalf | Ensures steady KiwiSaver growth even during periods of illness or injury and work interruptions |

| Mortgage protection insurance | Provides monthly benefits to cover rent or mortgage repayments if you can’t work due to illness or injury, preventing financial hardship withdrawals. Some plans also offer a retirement protection benefit | Protects your home and helps you continue saving for retirement amidst health challenges |

| Provides employees with collective cover, reducing out-of-pocket medical costs that might need to be funded by early KiwiSaver withdrawals | Makes financial protection more affordable, helping employees maintain retirement contributions and protect their nest egg |

|

| Protects business owners against risks like a serious illness, disability, or loss of a key person, so they don’t need to pull from KiwiSaver for business expenses | Ensures business continuity while allowing personal KiwiSaver savings to remain untouched |

- Life cover. The lump sum payout can help sort debts, end-of-life care expenses, and funeral costs, so your family isn’t left needing to use their KiwiSaver to cover these, allowing it to remain invested for their future.

- Private medical insurance. This cover pays for major healthcare expenses, such as private hospitalisation, costly surgeries, cancer care, and life-extending or life-saving non-Pharmac-funded drugs. This means you can leave your KiwiSaver intact rather than use it to fund medical care, keeping your investments compounding. Having health insurance also helps you avoid long public wait times, so you can be treated promptly and get back to work sooner.

- Trauma / critical illness insurance. This provides a lump sum payout if you’re diagnosed with a covered serious illness or injury, helping you manage treatment, home modification, and living costs while taking time off work. This buffer means you can avoid applying for KiwiSaver hardship withdrawals and even continue contributing to KiwiSaver while you recover.

- Total permanent disability insurance. A lump sum benefit is paid out if you are permanently disabled. It means you can keep your retirement plan on track instead of cashing in your KiwiSaver early to fund home modifications, medical, and daily living costs.

- Salary protection insurance or mortgage protection insurance. These provide monthly benefits if you can’t work due to illness or injury. By replacing a portion of your income, you can manage ongoing expenses, including rent or mortgage repayments, without dipping into your KiwiSaver. Some plans even allow you to add a retirement contribution benefit option so your KiwiSaver can continue to grow even while you’re not working.

- Group insurance. Being part of an employer-provided group insurance scheme gives you access to affordable cover. Lowering out-of-pocket medical expenses helps you maintain consistent contributions to KiwiSaver and other investments.

- Business insurance. This cover ensures business continuity if you or a key person in your business becomes critically ill, disabled, or passes away. It helps you avoid using your KiwiSaver to cover operational costs and debt payments, keeping your personal retirement savings secure.

Before and during retirement, insurance plays a key role in protecting what you’ve built. Cancelling policies to save on premiums might seem practical, but insurance can provide critical support if a serious illness or injury, permanent disability, or sudden death occurs. With the right type of insurance, your family can manage expenses without draining KiwiSaver.

For example, if you have limited savings and are still paying off a mortgage and other debts, consider whether you’d need life insurance to ensure your family can pay off health expenses, your home loan, and, in case of your death, funeral costs.

Policywise can help you compare plans from New Zealand’s most trusted insurers and customise your cover to better fit your needs and budget. Working with an adviser gives you peace of mind that your insurance plan not only protects your family today but also secures your future retirement.

RECOMMENDED READINGS

What types of insurance do you need in NZ?

Top KiwiSaver providers (2026 comparison)

Ethical KiwiSaver funds: 2026 investment options

KiwiSaver withdrawal rules and how insurance can help during tough times

How to beat the motherhood penalty and protect your KiwiSaver

Why choose Policywise as your retirement partner

At Policywise, we make it easy for you to grow and protect your retirement funds. We provide independent KiwiSaver advice and help you choose funds that match your long-term goals. We also ensure you’re set up with the right insurance cover so your retirement plans don’t fall apart even if critical illness, injury, disability or death impacts your personal or family income.

Check out the reviews on our homepage for how other New Zealanders have found our service, because now is the time to get your retirement and insurance plans sorted. Give your family or someone you love the most outstanding financial support possible. Book a 5-minute callback with Policywise today; our service is fast and free.

Important Disclaimer: The information on this website is general in nature and does not consider your personal situation. It is not intended as a definitive financial guide. Before making any KiwiSaver or insurance decisions, we recommend speaking with a licensed Policywise adviser.

Policywise advisers are licensed by the Financial Markets Authority to give financial advice on KiwiSaver and health, life, and disability insurance. For more, see our Public Disclosure page.

All insurance is subject to insurer approval. Policies may include stand-down periods, exclusions, terms and conditions, and premium loadings not listed here. Optional (add-on) benefits come at an extra cost. Please refer to the relevant policy document for full and current details, as insurers may update these at any time.

Product pages on this site are summaries only. In the case of any difference between website content and the provider’s official policy wording, the provider’s wording will apply.

Quickly find the cover that’s best for you

Policywise tells you which health, life or disability insurance best matches your circumstances, 100% free. Talk to one of our insurance advisers to find out which life insurance is best for you.

References

Age Concern New Zealand. (n.d.). Working after 65. Retrieved 24/09/2025 https://www.ageconcern.org.nz/Public/Public/Info/Money_and_Legal/Working_after_65.aspx

Consumer NZ. (n.d.). Reverse mortgages. Retrieved 24/09/2025 https://www.consumer.org.nz/articles/reverse-mortgages

Employment New Zealand. (2024, December 3). Retirement. Retrieved 08/10/2025 https://www.employment.govt.nz/ending-employment/retirement

Inland Revenue. (2021, April 28). KiwiSaver for individuals. Retrieved 12/10/2025 https://www.ird.govt.nz/kiwisaver/kiwisaver-individuals

New Zealand Government. (2020, October 2). Retirement age. Retrieved 24/09/2025 https://www.govt.nz/browse/work/retirement/retirement-age/

New Zealand Government. (2024, July 1). Applying for NZ Superannuation. Retrieved 24/09/2025 https://www.govt.nz/browse/tax-benefits-and-finance/new-zealand-superannuation-and-the-veterans-pension/applying-for-nz-superannuation/

NZ Fin-Ed Centre, Massey University. (2025, January). New Zealand retirement expenditure guidelines 2024. Retrieved 12/10/2025 https://www.massey.ac.nz/documents/2145/new-zealand-retirement-expenditure-guidelines-2024.pdf

Retirement Commission Te Ara Ahunga Ora. (2021). An introduction to New Zealand Superannuation. Retrieved 08/10/2025 https://assets.retirement.govt.nz/public/Uploads/Retirement-Income-Policy-Review/TAAO-RC-Policy-Paper-2021-03-SUMMARY.pdf

Retirement Commission Te Ara Ahunga Ora. (2025). Hynds, A., Leonard, C., & Bidois, T. Iwi managed investment/savings schemes 2025. Retrieved 24/09/2025 https://assets.retirement.govt.nz/public/Uploads/Retirement-Income-Policy-Review/2025-RRIP/Ihi_RC_Report_Iwi-managed-investment_2025_final.pdf

RNZ. (2025, March 17). Edmunds, S. What average KiwiSavers’ balances are at your age. Retrieved 24/09/2025 https://www.rnz.co.nz/news/business/545015/what-average-kiwisavers-balances-are-at-your-age

Sorted. (n.d.). About NZ Super. Retrieved 24/09/2025 https://sorted.org.nz/guides/retirement/about-nz-super/

Sorted. (n.d.). NZ Super rates – How much is New Zealand Superannuation? Retrieved 24/09/2025 https://sorted.org.nz/guides/retirement/this-years-nz-super-rates/

Sorted. (n.d.). How to plan, save and invest for retirement. Retrieved 24/09/2025 https://sorted.org.nz/guides/retirement/how-to-plan-save-and-invest-for-retirement/

Stats NZ. (n.d.). Life expectancy. Retrieved 24/09/2025 https://www.stats.govt.nz/topics/life-expectancy/

Stuff.co.nz. (2018, May 24). Stock, R. 65 with a mortgage leads to boom in retirees taking out life insurance. Retrieved 24/09/2025 https://www.stuff.co.nz/business/money/103839941/silver-mortgages-leading-to-boom-over-65s-paying-for-life-insurance

Victoria University of Wellington. (2025, August). Hynds, A., & Leonard, C. Managed iwi investment schemes: an exploratory study on retirement. Retrieved 13/10/2025 https://ojs.victoria.ac.nz/pq/article/view/9940/8749

Work and Income Te Hiranga Tangata. (n.d.). New Zealand Superannuation. Retrieved 24/09/2025 https://www.workandincome.govt.nz/eligibility/seniors/superannuation/index.html

ON THIS PAGE

Download our insurance comparison chart

We need a few details before we can send you this content…

* All fields are required