A review of Asteron Life Insurance in New Zealand: Your financial anchor amid life's changes

Discover comprehensive protection with Asteron Life Insurance NZ. Tailor your cover; secure your family's future. Get a quote today.

9 min to read

On this page

- Asteron Life Insurance - a brief company overview

- What is life insurance?

- What you should know about Asteron Life cover

- Asteron Life also offers

- Get your personalised Asteron Life Insurance quote

- Life insurance as part of financial planning

- Do you need Asteron Life Insurance in New Zealand?

- Policywise: your partner in making wise insurance decisions

- Conclusion

“We’re in this for life.”

Asteron Life's history of insuring New Zealanders spans 143 years and the company has been an integral part of the Kiwi community for the duration. Though their name has changed over the years - you might have known them as Royal and Sun Alliance - Asteron’s commitment to their core values remains steadfast. As 2021 winner of the NZ Insurance Awards ‘Life Insurance Company of the Year’ accolade, Asteron has every right to be proud of the contribution it makes to the life insurance landscape of New Zealand.

Learn more about different types of insurance from a licenced financial adviser and see what's best for your circumstances.

Health | Life | Trauma | Total and Permanent Disability | Income Protection

Learn more about different types of insurance from a licenced financial adviser and see what's best for your circumstances.

Health | Life | Trauma | Total and Permanent Disability | Income Protection

Asteron Life Insurance - a brief company overview

Asteron is backed by Suncorp New Zealand, a prominent player in the general and life insurance sector. Suncorp New Zealand is part of Suncorp Group, with more than 9 million customers and over A$96 billion in assets - a reassuring promise of Asteron's financial stability (rated AA- by Standard & Poor’s) when you need to make a claim. The Asteron claims team has successfully had 95% of claims accepted, providing $116.3 million to customers from 01 July 2021 to 31 June 2022.

Asteron Life provides insurance products specifically tailored towards the Kiwi lifestyle and aims “to help build bright futures and protect what matters most.” Policywise works with the full suite of Asteron products, including life, trauma, income protection, total and permanent disablement, and business cover. In this Asteron Life Insurance review, we’ll look at some of these plans in detail.

| Key facts about Asteron Life NZ |

| Founded: 1985 Location: Wellington, New Zealand Premium revenue: Not available Accumulated claims paid: $116.3M (2022) Solvency margin: $31.8m Solvency ratio: 108% Financial strength rating: AA- (strong) (Standard & Poor’s) |

What is life insurance?

Life insurance provides a lump sum payout on the death of the life insured. It is paid to the beneficiaries listed under the policy and provides a safety net that wraps around your loved ones when life takes an unexpected turn.

Here’s how life insurance works: You take out a life insurance policy through an insurance company and pay a cost, called a premium, on a regular basis. In return, if you pass away, your insurance company will pay the full sum insured to the policy beneficiaries, providing them with a financial cushion. It's like saying, "Even if I'm not around, I've got your back."

What you should know about Asteron Life cover

Asteron Life offers two distinct life insurance options. Each is designed to cater to different circumstances, ensuring that you have the right protection for your unique needs. Let's take a closer look at both:

1. Asteron Life Insurance: Safeguarding your family's future

Asteron Life Insurance is a robust provider that supplies a lump sum payout in the event of your passing away or a terminal illness diagnosis.

|

BENEFITS |

HOW IT HELPS |

|

Financial security |

Ensures your family’s financial comfort |

|

Debt clearance |

Settles mortgages, loans, and debts |

|

Childcare support |

Offers financial assistance for childcare |

|

Future planning |

Secures your children’s education and dreams |

|

Terminal illness support |

Access funds if diagnosed with a terminal illness |

|

Funeral advancement |

Immediate funds for funeral expenses |

2. Asteron Accidental Death Insurance: Shielding against the unforeseen

Asteron's Accidental Death Insurance cover provides a lump sum payout if you pass away due to an accident.

|

BENEFITS |

HOW IT HELPS |

|

Mortgage and debt relief |

Clears mortgages, loans, and debts |

|

Childcare assistance |

Support for childcare if a primary caregiver passes away |

|

Income assistance |

Provides extra income for the family |

|

Funeral cover |

Covers funeral costs so you can grieve without financial stress |

Asteron Life also offers

- Asteron Trauma Cover: Offers a lump sum payment upon diagnosis of a covered condition, helping you cover medical expenses, debts, or any necessary lifestyle adjustments. Designed to provide financial support if you are diagnosed with one of the many conditions defined under the policy wording.

- Income Protection Cover: This covers up to 75% of your income, providing you with a reliable source of income if you cannot work due to illness or injury. It offers regular payments to help you meet financial commitments such as bills, rent or mortgage, and daily living expenses.

- Total and Permanent Disablement Cover: Offers a lump sum payment to help you maintain ongoing expenses, rehabilitation, and lifestyle modifications. This cover provides financial security if you suffer a complete and permanent disability that prevents you from working.

- Business Cover: Designed to protect your business in case you or a key person in your organisation becomes unable to work due to illness or injury. It can provide funds to cover ongoing business expenses, hire temporary staff, or support the business during a challenging period.

Get your personalised Asteron Life Insurance quote

Life's journey isn't a cookie-cutter experience; your insurance shouldn't be either. Asteron Life allows you to tailor your cover to suit your specific needs.

Asteron Life has a user-friendly platform that supplies personalised quotes, helping you explore different options and giving you the power to choose what works best for you.

Please note: Terms and conditions, as well as exclusions, apply to all Asteron Life products. It's important to review your policy carefully to understand the specific terms of cover and any limitations. This ensures that you have a clear understanding of the protection provided by each product. If you have any questions or would like some help finding the right policy, book a callback with a Policywise adviser; it's fast and free.

Life insurance as part of financial planning

Including life insurance as part of your overall financial planning is a smart move. Here's how to integrate it effectively:

- Assess your needs: Calculate how much cover your family would require to maintain their lifestyle.

- Consider your goals: Think about long-term financial goals and how life insurance could aid them.

- Regular reviews: Life changes; so should your policy. Periodically review and update your cover.

- Budget wisely: Life insurance is an investment. Allocate a part of your budget for it.

- Seek qualified advice: Consulting with an insurance advisor, such as Policywise, can help you make an informed decision.

- Explore Policywise: See how Policywise can accommodate your life insurance needs. You can check Policywise’s online reviews and testimonies to see how other New Zealanders have found our service.

Do you need Asteron Life Insurance in New Zealand?

Life insurance is a promise to secure your loved ones' future on death. Here's why it matters:

- Financial security: Life insurance provides a financial backup for your family on death.

- Debt protection: It can help cover debts, rents, mortgages, and loans, relieving your loved ones from the burden.

- Income replacement: Helps replace the income of the deceased life assured, enabling the family to maintain a similar lifestyle to that if the life assured had continued working until retirement.

- Education support: Ensures your children's education remains uninterrupted, no matter what.

- Funeral costs: Eases the financial strain by covering funeral expenses.

- Peace of mind: Knowing that your loved ones are taken care of after you're gone offers invaluable peace of mind.

Policywise: your partner in making wise insurance decisions

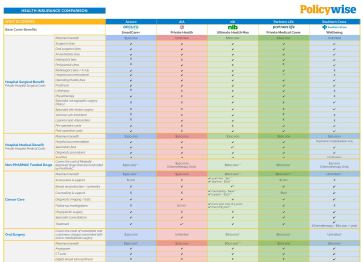

Policywise is a 100% free service which tells you which health, life, and disability insurance provider best fits your needs. We offer fast, comprehensive, and easy-to-understand comparisons of all leading providers, and a simple summary clearly recommending which insurer is best for your situation.

Not all insurance policies are the same. Policywise can help you sort out the duds, avoid the lemons, understand the fine print and exclusions, and get the right insurance for you and your family.

We make the important decision of where to buy your insurance super easy. We’ll answer your questions, provide experienced advice, quotes, and comparisons, and manage all the back and forth throughout the application process. Taking out your cover through us means you'll have our lifetime support and claims advocacy, and we'll help you negotiate a positive outcome at claim time. We can also take care of lodging any claims on your behalf and back you up if the going gets tough.

Check out the reviews on our homepage for how other New Zealanders have found our service because now is the time to get your life insurance sorted. Give your family or someone you love the most outstanding financial support possible. Book a 5-minute callback with Policywise today; our service is fast and free.

Conclusion

Asteron Life New Zealand isn't just about insurance – it's your dependable partner in securing a comfortable future. You'll find tailored options, a proven track record, and a strong commitment to safeguarding your loved ones' wellbeing. Opt for Asteron Life Insurance today and ensure a secure tomorrow.

Quickly find the cover that’s best for you

Policywise tells you which health, life or disability insurance best matches your circumstances, 100% free. Talk to one of our insurance advisers to find out which health or life insurance is best for throat cancer, and other serious illnesses.

FAQs

Does health insurance have a free-look period?

Yes. Health insurers offer a 14-day free-look period. If you decide it does not meet your needs or expectations, you can return the policy within this period to get a refund of the premium.Will health insurance cover loss of income?

Most health insurance plans do not cover loss of income. If you’d like to have this cover, talk to a Policywise adviser so they can help you get the best critical illness insurance.Critical illness insurance is a one-time lump sum payment in the event you are diagnosed with an illness covered by the policy. This amount can be used to cover household expenses like food, loans, rent and utilities while a patient undergoes treatment or recovery.

My employer offers a health insurance benefit. Do I still need to have my own insurance plan?

Review your workplace health insurance plan’s inclusions and exclusions. Does it cover your partner and your children? Do the benefits offer sufficient cover for your family?We can review your plan and suggest options to give your family better health and financial protection. Click here to schedule a callback from one of our expert advisers.

What health insurance plan would you recommend for senior citizens?

Several health insurers provide cover for senior citizens. Since packages differ in terms of coverage and pricing, a Policywise specialist can help you compare quotes and benefits.What is the best family health insurance plan?

The best family health insurance plan will depend on several factors, like:- the number of children you have

- the age of your dependents

- your family members’ health circumstances (e.g. whether or not your baby has pre-existing conditions

Several health insurers have special packages for families, or plans that allow you to include eligible family members and add future children. Others offer kids-only insurance, which does not require parents to buy their own insurance.

Click the button to learn more and get protected:

References

Asteron Life NZ. (n.d.-a). Retrieved 08/01/2023 https://www.asteronlife.co.nz/

Fontinelle, A. (n.d.). Life insurance: What it is, how it works, and how to buy a policy. Investopedia. Retrieved 08/01/2023 https://www.investopedia.com/terms/l/lifeinsurance.asp

Asteron Life NZ. (n.d.-b). Get insurance for accidental death. Retrieved 08/01/2023 https://www.asteronlife.co.nz/insurance/accidental-death-insurance.html

Asteron Life NZ. (n.d.-c). What is life insurance? Retrieved 08/01/2023 https://www.asteronlife.co.nz/insurance/life-insurance.html